Washington State’s SNAP (Basic Food) program helps low-income households afford groceries. If you live in Washington and want to know how much you can earn and still qualify for SNAP benefits, this updated 2026 guide will walk you through every detail — from income limits to eligibility rules, benefit calculation examples, and how to apply through Washington Connection.

What Is Washington SNAP (Basic Food)?

Supplemental Nutrition Assistance Program (SNAP) — called Basic Food in Washington — provides monthly food benefits to eligible low-income individuals and families. The program is funded by the USDA and managed locally by Washington State DSHS (Department of Social and Health Services).

SNAP benefits are loaded monthly on an EBT (Electronic Benefits Transfer) card, which works like a debit card at authorized grocery stores and farmers’ markets across the state.

Why It Matters

With rising food costs, over 920,000 Washingtonians rely on SNAP to cover essential grocery needs. Income limits are adjusted every year based on the Federal Poverty Level (FPL) and the Cost-of-Living Adjustment (COLA).

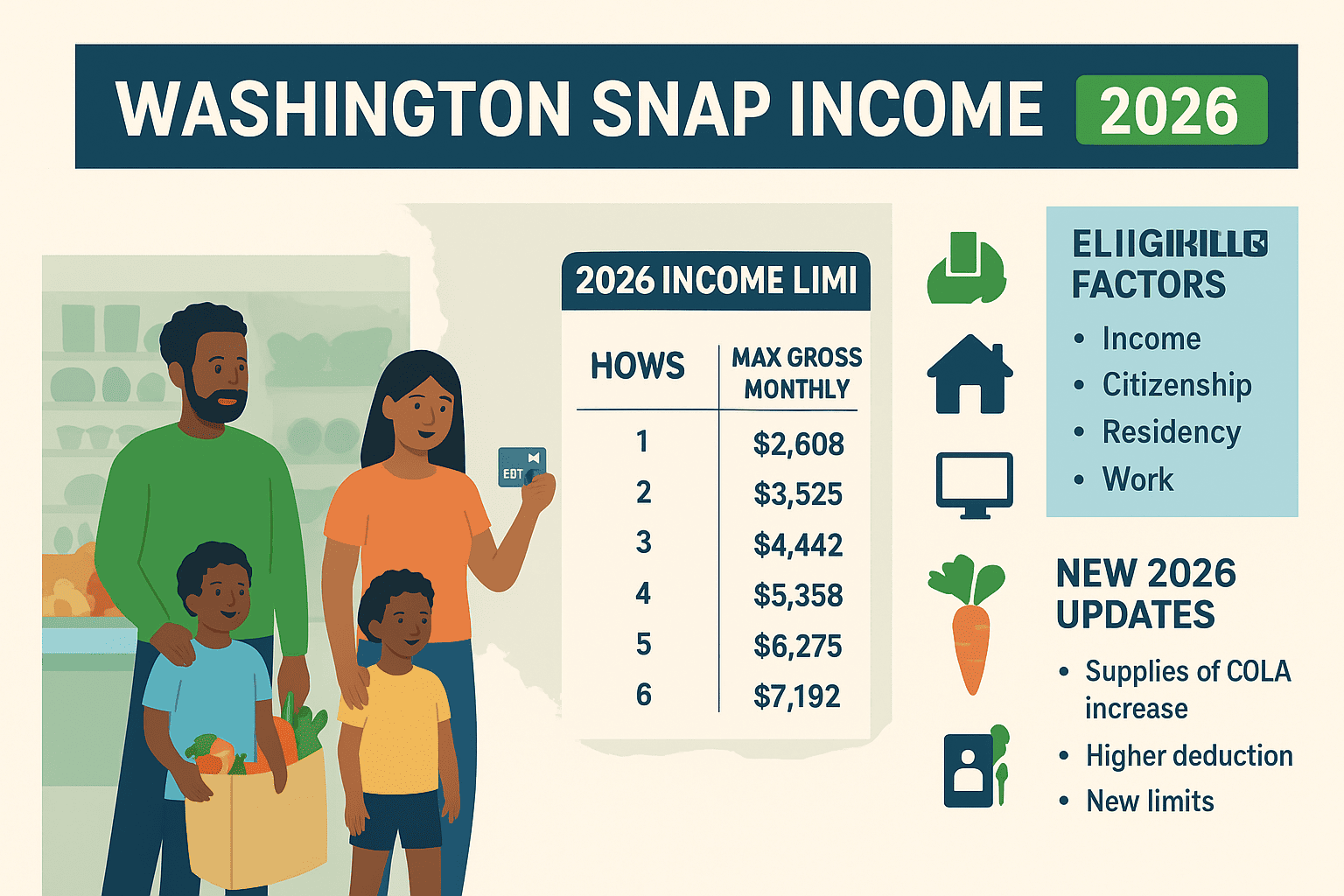

Washington SNAP Income Limits 2026 (Gross Monthly)

Below is the official FY26 income limit table for Washington, effective October 1, 2025 – September 30, 2026.

If your gross monthly income (before taxes and deductions) is below these limits, you may qualify.

| Household Size | Maximum Gross Monthly Income (FY26) |

| 1 | $2,608 |

| 2 | $3,525 |

| 3 | $4,442 |

| 4 | $5,358 |

| 5 | $6,275 |

| 6 | $7,192 |

| Each additional person | +$917 |

Source: USDA & Hunger Free WA (FY2026 income standards)

Tip: If your income is slightly above these limits, you may still qualify under categorical eligibility if your household receives certain benefits like TANF or SSI.

Gross vs. Net Income — What’s the Difference?

Gross Income:

Total income before taxes or deductions — includes wages, self-employment earnings, unemployment benefits, or Social Security (non-exempt).

Net Income:

What remains after allowable deductions are subtracted from gross income. Deductions may include:

- Standard deduction (varies by household size)

- Earned income deduction (20%)

- Dependent care expenses

- Medical costs for elderly or disabled members

- Excess shelter costs (rent + utilities)

To qualify, most households must meet both gross and net income limits, except households with elderly or disabled members (who only need to meet net limits).

Example: How Income Calculation Works

Let’s look at a real-world example:

Household: 3 people (2 adults, 1 child)

Gross income: $4,800/month

Step 1 — Apply deductions:

- Standard deduction (FY26): $209

- Earned income deduction: 20% of $4,800 = $960

- Dependent care expenses: $200

Net Income = $4,800 − ($209 + $960 + $200) = $3,431

This household’s net income ($3,431) is compared to the 100% FPL net limit for 3 people (around $3,416).

Result: Slightly over, but may still qualify depending on allowable shelter deductions.

Key insight: Always apply all deductions before assuming ineligibility — many households qualify after adjustments.

How SNAP Benefits Are Calculated (FY2026)

Once eligible, your benefit (allotment) depends on household size and net income.

Formula:

Maximum Allotment – (30% of Net Income) = Monthly SNAP Benefit

For FY26, the maximum allotments for the contiguous U.S. (including Washington) are:

| Household Size | Maximum SNAP Allotment (FY26) |

| 1 | $291 |

| 2 | $535 |

| 3 | $766 |

| 4 | $994 |

| 5 | $1,181 |

| 6 | $1,414 |

Example:

Household of 4 with $2,000 net income.

→ 30% of $2,000 = $600

→ $994 (max allotment) − $600 = $394 monthly SNAP benefit

Who Qualifies for Basic Food in Washington (2026)

To qualify, you must meet both income and eligibility conditions:

General Eligibility Checklist:

- Live in Washington State

- Meet income limits for your household size

- Be a U.S. citizen or qualified immigrant

- Provide Social Security numbers for all members

- Not be disqualified due to certain violations

Special Rules:

- Students: Must meet specific work, care, or program participation exemptions

- Elderly/Disabled: Only need to meet net income test, not gross

- Mixed households: Eligibility depends on combined resources

Step-by-Step: How to Apply for SNAP in Washington

You can apply in three convenient ways:

Online (Recommended)

Apply through the Washington Connection Portal — the fastest and easiest way.

You can:

- Submit your SNAP (Basic Food) application

- Upload required documents

- Check application status anytime

By Mail or Phone

- Call DSHS Customer Service: 1-877-501-2233

- Request a paper form and mail it to your local Community Services Office (CSO)

In Person

Visit your nearest DSHS CSO with:

- Photo ID

- Proof of income (pay stubs, benefit letters)

- Proof of residence and expenses (rent, utilities)

After applying: You’ll complete a brief eligibility interview (usually by phone). DSHS will then mail or email your benefit decision.

2026 SNAP Program Updates & Key Changes

FY2026 includes several updates that impact Washington households:

- COLA Adjustment: SNAP income limits increased by approximately 3.2% nationwide.

- Higher Maximum Allotments: Reflecting rising food costs under USDA’s Thrifty Food Plan.

- Digital Access Expansion: More stores in Washington now accept online EBT payments via Amazon, Walmart, Safeway, and Instacart.

- Longer Certification Periods: Many households now qualify for 12-month approvals.

Stay updated: Recheck your eligibility each year on October 1 when new limits are released.

Common Deductions You Should Know (FY26)

Understanding deductions can make the difference between qualifying or not.

Here are the most common allowable deductions:

| Deduction Type | FY26 Example Amount / Rule |

| Standard Deduction | $209 (1–3 people) |

| Earned Income Deduction | 20% of gross earnings |

| Dependent Care | Actual cost (if work-related) |

| Medical Expenses | Over $35/month (elderly/disabled) |

| Excess Shelter Costs | Rent + utilities − (50% of income) |

Pro Tip: Always report rent, child care, or medical expenses — they can significantly lower your net income and increase your benefit.

Washington SNAP Income Limits 2026 (FAQ)

A: $3,525 per month (FY26).

A: Up to $5,358 gross income per month before deductions.

A: Up to $994/month if they have no countable income. Actual benefits decrease as income rises.

A: Yes — if they meet exemption criteria (working 20+ hours/week, caring for dependents, or enrolled in certain training programs).

A: Report any income change to DSHS within 10 days — your benefits may increase, decrease, or stay the same based on updated income.

Final Step — Check Eligibility & Apply Now

If your household income falls within the 2026 Basic Food limits, you may qualify for monthly SNAP benefits.

👉 Check your eligibility on Washington Connection

👉 Apply for Basic Food benefits here

📞 For help, call 1-877-501-2233 or visit your nearest DSHS Community Services Office.

Don’t miss out — the average Washington household saves over $250/month in grocery costs with SNAP benefits. Find out more detail from Snapusda.com