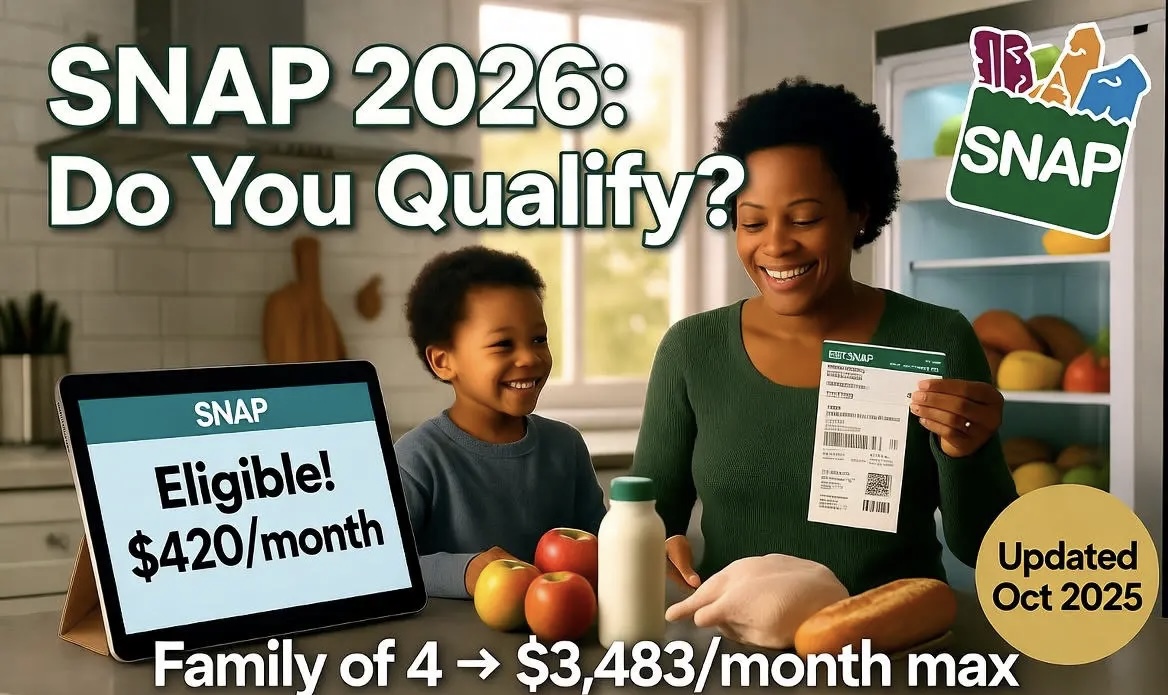

The SNAP income limits by state 2026 are here, and they could mean more food stamps eligibility for millions of families. With rising costs for groceries and rent, the Supplemental Nutrition Assistance Program (SNAP)—once called food stamps—helps low-income households buy healthy food. In fiscal year 2026 (October 1, 2025, to September 30, 2026), the U.S. Department of Agriculture (USDA) raised maximum SNAP benefits by about 3.1% to match inflation. This SNAP COLA 2026 update boosts gross income limits, net income limits, and deductions, making it easier to qualify.

If you’re wondering, “Do I qualify for SNAP 2026?” or “What are the new SNAP income limits for 2025-2026?”, you’re in the right place. This guide covers SNAP eligibility calculator tools, state-specific SNAP information, and food stamp limits 2026 for all 50 states. We’ll explain what income counts for SNAP, asset limits, work requirements, and more. About 42 million Americans rely on SNAP benefits 2026 to fight food insecurity—check if you can join them.

Interactive SNAP Eligibility Calculator 2026

Before we dive into charts and rules, let’s make this personal. Our free SNAP calculator 2026 takes just 60 seconds. Enter your details to get a custom report on SNAP gross and net income limits by household size, deductions, and potential maximum SNAP benefits family of 4 or any size.

How to Use the SNAP Calculator

- Select your state (e.g., Texas SNAP income limits 2026).

- Enter household size (include kids, seniors, disabled members).

- Add monthly gross income (wages, Social Security, unemployment).

- Include expenses (rent, utilities, childcare, medical costs over $35 for elderly/disabled).

- Hit “Calculate” for your net income result and how much SNAP will I get 2026.

Example Output: “Based on your $2,500 gross income in California (200% FPL expansion), you qualify for $450/month in SNAP benefits after deductions.”

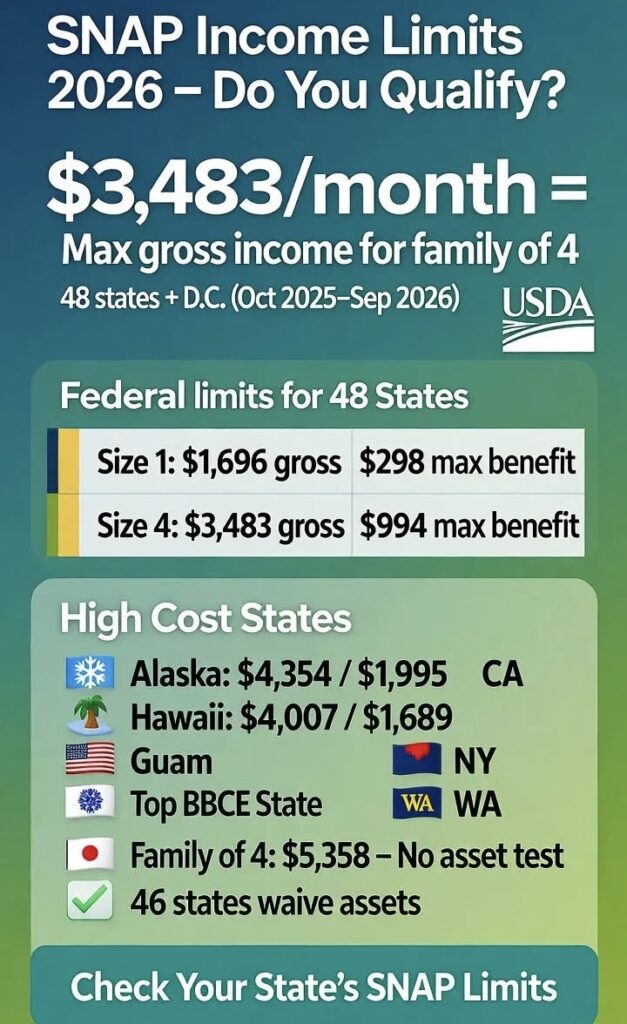

SNAP eligibility starts with federal rules, but states tweak them via BBCE. In the 48 contiguous states and D.C., gross monthly income must be at or below 130% FPL, and net monthly income (after deductions) at 100% FPL. High-cost areas like Alaska and Hawaii have higher SNAP income thresholds.

Here’s the federal baseline SNAP income limits by household size for 2026:

| Household Size | Gross Monthly Income Limit (130% FPL) | Net Monthly Income Limit (100% FPL) | Max Monthly Benefit |

| 1 | $1,696 | $1,304 | $298 |

| 2 | $2,298 | $1,772 | $546 |

| 3 | $2,900 | $2,239 | $785 |

| 4 | $3,483 | $2,680 | $994 |

| 5 | $4,085 | $3,121 | $1,183 |

| 6 | $4,688 | $3,562 | $1,421 |

| 7 | $5,290 | $4,003 | $1,571 |

| 8 | $5,892 | $4,444 | $1,789 |

| Each Additional Person | +$603 | +$441 | +$218 |

These SNAP gross and net income limits by household size apply unless your state expands via BBCE, which waives asset limits in most cases.

For high-cost areas:

| Region | Household of 1 Gross | Household of 4 Gross | Max Benefit (Family of 4) |

| Alaska (Rural 2) | $2,118 | $4,354 | $1,995 |

| Hawaii | $1,949 | $4,007 | $1,689 |

| Guam | $2,091 | $4,298 | $1,465 |

| Virgin Islands | $1,949 | $4,007 | $1,278 |

High-Cost States: Alaska, Hawaii, Guam, Virgin Islands

Living in Alaska food stamp limits or Hawaii SNAP income limits? Higher costs mean bigger SNAP benefits increase October 2025. Alaska has three tiers—Urban ($1,285 max for family of 4), Rural 1 ($1,639), and Rural 2 ($1,995)—due to remote access issues.

Why it matters: A single person in rural Alaska qualifies up to $2,118 gross, far above the federal $1,696. Use our calculator for Alaska SNAP gross monthly income limits. Guam and Virgin Islands follow adjusted FPLs for island economies.

Pro Tip: If you’re in these areas, check expedited SNAP for quick approval if income is under $150 gross + $100 assets.

State Expansions via BBCE – Who Qualifies for More?

Most states (46 + D.C.) use Broad-Based Categorical Eligibility (BBCE) to expand SNAP income limits by state 2026. This aligns with TANF programs, raising gross income to 200% FPL and often waiving asset limits. No state has lower limits than federal.

Top 10 Expanded States (200% FPL Gross for Family of 4: $5,358):

- California (CalFresh): No asset test; SNAP for immigrants 2026 easier.

- Washington: 200% FPL; SNAP work requirements 2026 changes flexible.

- New York: No asset limit; integrates with WIC.

- Oregon, Colorado, Maine, Massachusetts: All 200% FPL, no assets.

- Arizona: 185% FPL ($4,956 for 4); no assets.

- Illinois, Texas: 165% FPL ($4,420 for 4); assets apply in some cases.

Which States Waived the Asset Test in 2026? (46 Total): All except Alabama, Alaska (partial), Arkansas, Georgia, Idaho, Indiana, Mississippi, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Utah, Wyoming. These follow federal $3,000 assets.

Full 50-State SNAP Gross Income Limits Table (Family of 4, 2026)

Based on BBCE % FPL (federal 130% = $3,483 unless expanded). Assets: No if BBCE full waiver.

| State | Gross Limit (% FPL) | Family of 4 Gross | Apply Link |

| Alabama | 130% | $3,483 | AL DSS |

| Alaska | 200% (varies) | $4,354 (Rural) | AK DHSS |

| Arizona | 185% | $4,956 | AZ DES |

| Arkansas | 130% | $3,483 | AR DHS |

| California | 200% | $5,358 | CalFresh |

| Colorado | 200% | $5,358 | CO PEAK |

| Connecticut | 200% | $5,358 | CT DSS |

| Delaware | 200% | $5,358 | DE DHSS |

| District of Columbia | 200% | $5,358 | DC ESA |

| Florida | 200% | $5,358 | FL ACCESS |

| Georgia | 130% | $3,483 | GA Gateway |

| Hawaii | Federal Adjusted | $4,007 | HI DOH |

| Idaho | 130% | $3,483 | ID Idaho Food |

| Illinois | 165% | $4,420 | IL ABE |

| Indiana | 130% | $3,483 | IN Benefits |

| Iowa | 160% | $4,288 | IA IowaONE |

| Kansas | 200% | $5,358 | KS KEESM |

| Kentucky | 200% | $5,358 | KY Kynect |

| Louisiana | 200% | $5,358 | LA DCFS |

| Maine | 200% | $5,358 | ME MyBenefits |

| Maryland | 200% | $5,358 | MD mma |

| Massachusetts | 200% | $5,358 | MA DTA |

| Michigan | 200% | $5,358 | MI MiBridges |

| Minnesota | 200% | $5,358 | MN MNBenefits |

| Mississippi | 130% | $3,483 | MS MDHS |

| Missouri | 200% | $5,358 | MO MyDSS |

| Montana | 200% | $5,358 | MT Access |

| Nebraska | 130% | $3,483 | NE ACCESSNebraska |

| Nevada | 200% | $5,358 | NV Access |

| New Hampshire | 200% | $5,358 | NH DHHS |

| New Jersey | 185% | $4,956 | NJ NJHelps |

| New Mexico | 200% | $5,358 | NM Yes |

| New York | 200% | $5,358 | NY myBenefits |

| North Carolina | 200% | $5,358 | NC ePASS |

| North Dakota | 200% | $5,358 | ND ND SNAP |

| Ohio | 130% | $3,483 | OH Ohio Benefits |

| Oklahoma | 130% | $3,483 | OK ACCESS |

| Oregon | 200% | $5,358 | OR ONE |

| Pennsylvania | 200% | $5,358 | PA COMPASS |

| Rhode Island | 185% | $4,956 | RI DHS |

| South Carolina | 130% | $3,483 | SC Benefits |

| South Dakota | 130% | $3,483 | SD ACCESS |

| Tennessee | 130% | $3,483 | TN Oneida |

| Texas | 165% | $4,420 | TX YourTexasBenefits |

| Utah | 130% | $3,483 | UT MyCase |

| Vermont | 185% | $4,956 | VT EBAY |

| Virginia | 200% | $5,358 | VA CommonHelp |

| Washington | 200% | $5,358 | WA Washington Connection |

| West Virginia | 200% | $5,358 | WV WV PATH |

| Wisconsin | 200% | $5,358 | WI ACCESS |

| Wyoming | 130% | $3,483 | WY SNAP |

Note: Gross limits for elderly/disabled often exempt the gross test—only net applies. Verify at state links.

SNAP Deductions That Boost Your Eligibility

Deductions lower your countable income, turning “maybe” into “yes” for SNAP eligibility. They include standard deduction, shelter costs, and more. In 2026, the shelter deduction cap rose to $744 in 48 states—key for renters.

Common SNAP Deductions List

- Standard Deduction: Automatic for all—$209 (1-3 people), $223 (4), $261 (5), $299 (6+) in 48 states.

- Earned Income Deduction: 20% off work pay (e.g., $2,000 job → subtract $400).

- Dependent Care: Up to $200/child under 2, $175/older kids for work/school.

- Medical Expenses: For 60+ or disabled, subtract over $35/month (no cap).

- Shelter Costs: Rent/mortgage + utilities over half your income, capped at $744 (uncapped for elderly/disabled).

- Homeless Shelter Deduction: $198.99/month nationwide.

2026 Shelter Cap Increase: $744 → How It Helps Renters: If rent is $1,000 and income $2,000, deduct up to $744 after half-income calc, slashing net income by hundreds.

Pro Tip: Track bills for “SNAP deductions lower your income”—it could add $100+ to your benefit.

Real-Life Eligibility Examples

See SNAP eligibility calculator example in action with these scenarios. All use 2026 rules.

Example 1: Single Mom in Texas (3-Person Household)

- Gross Income: $2,500 (job + child support).

- Expenses: Rent $900, utilities $150, childcare $300.

- Calc: Gross under $2,900 ✓. Net: $2,500 – $209 std – $500 (20% work) – $300 care – $712 shelter = $779 (under $2,239 ✓).

- Result: Qualifies for $600/month SNAP (75% working families get it).

Senior Couple in Florida (2-Person)

- Gross: $1,800 Social Security.

- Expenses: Rent $700, medical $150.

- Calc: No gross test (elderly). Net: $1,800 – $209 – $115 med ($150-$35) – $565 shelter = $911 (under $1,772 ✓).

- Result: $300/month—food stamps for seniors 2026 often ignore gross.

Example 3: Family of 5 in California (200% Expansion)

- Gross: $4,500.

- Expenses: Rent $1,500, utilities $200.

- Calc: Under $6,276 (200% FPL) ✓. Net after deductions: $3,200 (under $3,121 ✓).

- Result: $800/month—BBCE helps “can working families get food stamps”.

How to Apply for SNAP in 2026 (Step-by-Step)

Ready for “how to apply for food stamps”? It’s free and fast—most states offer online apps.

Step-by-Step SNAP Application Process

- Gather Documents: Photo ID, pay stubs (last 30 days), bank statements, utility bills, Social Security cards. For “SNAP for disabled adults 2026”, add medical proof.

- Choose Method: Online (42 states, e.g., SNAP application online [state]), phone, or in-person at local office.

- Submit & Interview: Upload docs; phone interview in 7-30 days (most states).

- Get Decision: Approval in 30 days (7 for emergency SNAP if low income/high costs).

- Receive EBT Card: Load SNAP benefits monthly; use at stores/farmers markets.

Emergency SNAP: Get Benefits in 7 Days: If gross <$150 + assets <$100, qualify for fast track. Report changes within 10 days to avoid “SNAP overpayment 2026 rules”.

Report Changes or Risk Overpayment

Got a raise? Tell your caseworker within 10 days if income rises $125+. This keeps benefits accurate—failure leads to repayment.

SNAP Overpayment Forgiveness 2026 – New Rules: USDA now waives small errors (<$125) if unintentional. Use state portals for updates.

Special Rules You’re Probably Missing

SNAP rules 2026 vary by group. Here’s a quick table:

| Group | Key 2026 Rule |

| Seniors (60+) | Skip gross income test; unlimited shelter deduction; medical over $35. |

| Disabled | Higher asset limits $4,500; no time limits on benefits. |

| College Students | Qualify if work 20+ hrs/week or care for child under 6 (SNAP student rules 2026). |

| Immigrants | Citizens + 5-year LPR/refugees; some DACA eligible (can immigrants get SNAP). |

| ABAWDs (18-49, no kids) | Work/train 20 hrs/week or lose after 3 months (SNAP work requirements). |

SNAP asset test waived states 2026: 46 states—see table above.

What’s New in SNAP 2026? (USDA COLA Update)

The SNAP program changes for 2026 include:

- +3.1% max benefits (family of 4: $994).

- Assets unchanged: $3,000 standard.

- Thrifty Food Plan Re-Evaluation: Why Benefits Rose: USDA updated food costs, adding $19/month average.

How much SNAP benefits increase in 2026: Modest but vital amid 3% inflation.

FAQ – SNAP 2026

- Can I get SNAP if I own a car?

Yes, one vehicle doesn’t count; over $4,650 may (can I own a car and get SNAP). - Does Social Security count?

Yes, as countable income (does Social Security count as income). - How often do limits change?

Every October 1 (how often do SNAP limits change). - Can I use SNAP at farmers markets in 2026?

Yes, via HIP for double dollars on produce. - What if I’m denied SNAP benefits?

Appeal for fair hearing within 90 days (68% success). - Can I own a house and get SNAP?

Yes, home excluded (can I own a house and get SNAP). - Do unemployment benefits count as income for SNAP?

Yes, report them. - How often do I need to recertify for SNAP? 6-12 months.

- What if my income goes over the limit after I’m approved?

Report; benefits adjust. - Can working families get food stamps?

Yes, 75% of SNAP households work.

Conclusion: Secure Your Food Future with SNAP 2026

You’ve just unlocked the complete roadmap to SNAP income limits by state 2026—from federal charts and 50-state portals to deductions, real-life examples, and a free eligibility calculator. Whether you’re a working parent in Texas, a senior in Florida, or a family in California using 200% FPL expansions, SNAP benefits 2026 are built to help you.

Here’s the truth:

- 42 million Americans already rely on SNAP to eat healthier and stretch their budget.

- 75% of SNAP households work—this isn’t a handout, it’s food support for real life.

- With USDA’s 3.1% COLA increase, maximum benefits for a family of 4 now reach $994/month in most states—$1,995 in rural Alaska.

Don’t leave money on the table.

One quick application can put groceries on your table—no shame, just smart support.